Construction Industry

Construction business owners face a unique set of challenges. Through our CFO Services, we target several areas of the business.

CFO Services and Tax Services for Construction Companies

Managing cash flow in a construction business can be stressful with constant ups and downs, surprise cost increases, and collections issues, just to name a few.

Lagow CPA CFO Services take into account these specific details about your business by implementing our cash flow system in your accounting so we can track and analyze the ins and outs of your money.

We do this on a monthly basis so the numbers are updated and projected on an ongoing basis. Another benefit of implementing Cash Flow analysis is you can catch issues sooner, project where you stand, and know how long your cash will last.

Tax Planning

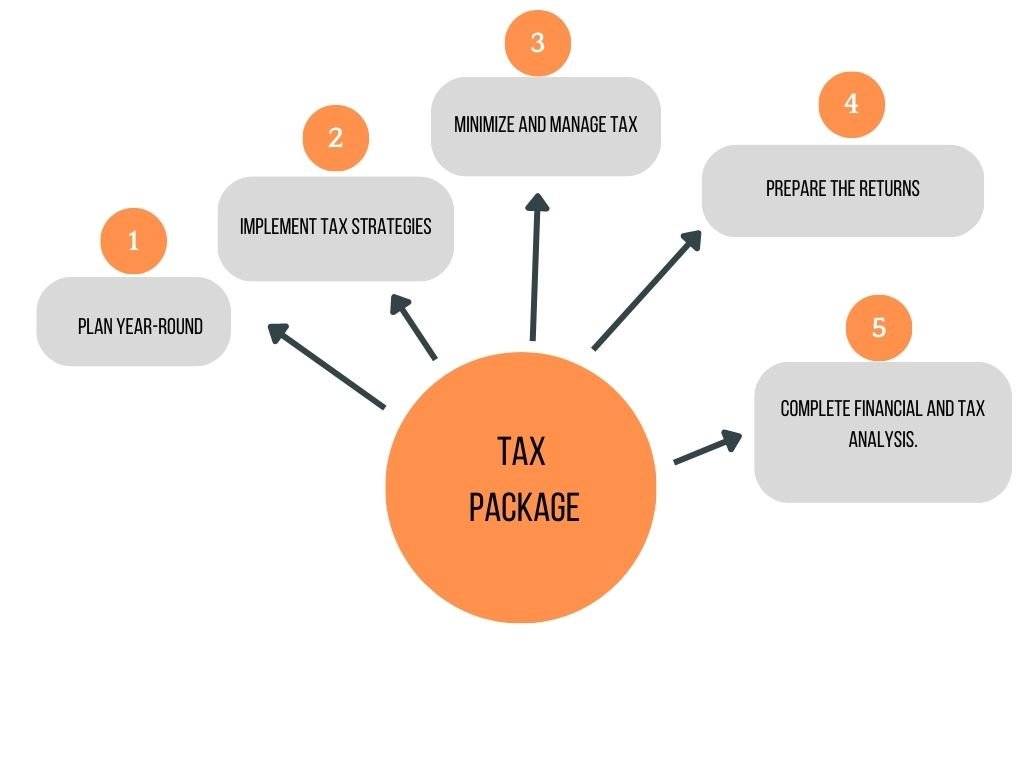

Our CFO services also include comprehensive tax planning. We plan year-round to minimize and manage tax implications of the business.

We implement tax strategies and prepare the returns for complete financial and tax analysis.